10 200 unemployment tax break refund status

What are the unemployment tax refunds. Press 2 for questions about your personal income taxes.

If you received unemployment benefits last yearyou may be eligible for a refund from the IRS.

. Filed HOH3 dependents and had unemployment all year due to closure of my work place. ARPA allows eligible taxpayers to exclude up to 10200 of unemployment compensation on their 2020 income tax return. This is the latest round of refunds related to the added tax exemption for the first 10200 of unemployment benefits.

How to speak directly to an IRS agent. The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189 to filers who paid too much in taxes for their 2020 unemployment benefits. There have been unconfirmed reports of people receiving their refund filing simple returns no dependents.

Press 3 for all other questions. The American Rescue Plan Act which was signed on March 11 included a 10200 tax exemption for 2020 unemployment benefits. Unemployment tax refunds started landing in bank accounts in May and ran through the summer as the IRS processed the returns.

ONLY THOSE WHO ARE AWAITING A SECONDARY REFUND DUE TO THE 10200 UNEMPLOYMENT TAX BREAK. Married filing jointly. The IRS has identified.

Basically you multiply the 10200 by 2 and then apply the rate. I racked up about 23000 in UE. Depending on where you live you may also need to pay state or local taxes on your unemployment benefits.

Signed on March 11 the 19 trillion American Rescue Plan exempts from federal tax up to 10200 of unemployment benefits received in 2020 or 20400 for married couples filing jointly for. Taxpayers eligible for the up to 10200 exclusion who have already filed 2020 taxes claiming their unemployment insurance benefits. The first refunds are expected to be issued in May and will continue into the summer.

The Internal Revenue Service IRS said that it would start sending tax refunds to those eligible for the 10200 unemployment tax waiver. The first10200 in benefit income is free of federal income tax per legislation passed in March. THE IRS is now sending 10200 refunds to millions of Americans who have paid unemployment taxes.

How would i know if i am getting a. The refunds will happen in two waves. This is only applicable only if the two of you made at least 10200 off of unemployment checks.

The American Rescue Plan Act which was signed on March 11 included a 10200 tax exemption for 2020 unemployment benefits. On March 11 President Joe Biden signed his 19 trillion American Rescue Plan into law which includes a tax break on up to 10200 of unemployment benefits earned in 2020. At the federal level unemployment is normally taxed as ordinary income but tax rates vary state by state.

This means you dont have to pay tax on unemployment compensation of up to 10200 on your 2020 tax return only. The American Rescue Plan Act waived federal tax on up to 10200 of 2020 unemployment benefits per person. And this tax break only applies to 2020.

Press 1 for questions about a form already filed or a payment. Extra refund checks for 10200 unemployment tax break will start going out in May The first refunds are expected to be made in May and will continue into the summer the IRS said. Potentially a state refund not federal so take this with a grain of salt Update 2.

-10200 Unemployment Tax Break if it says amending refund 2020 under your federal taxes is that how much you are getting back. Some states dont count unemployment benefits as. Around 10million people may be getting a payout if they filed their tax returns before the big tax break in the American Rescue Plan became law.

Under the American Rescue Plan signed into law Thursday the IRS will make the first 10200 in unemployment benefits from 2020 tax-free. The legislation allows taxpayers who earned less than 150000 in adjusted gross income to exclude unemployment compensation up. Yes Fourth Stimulus Check Update Irs Tax Refunds 10 200 Unemployment In 2021 Tax Refund Irs Taxes Checks.

The transcript will have transaction codes. Only up to the first 10200 of unemployment compensation is not taxable for an individual. Call the IRS at 1-800-829-1040 during their support hours.

For married taxpayers separate exclusions can apply to the unemployment compensation paid to each spouse. To reiterate if two spouses collected unemployment checks last year they both qualify for the 10200 tax break. President Joe Biden signed the pandemic relief law in March.

Said it would begin processing the simpler returns first or those eligible for up to 10200 in excluded benefits and then would turn to returns for joint filers and others with more complex returns. Enter the original amount you reported in column A the change in column B and the corrected amount in column C. Say it says 8305 i am so lost with this entire process.

The IRS is starting to send money to people who fall in this categorywith more refunds slated to arrive this summer. The refunds totaled more than 510 million. Those amending their income to remove unemployment payments for instance would.

The American Rescue Plans 10200 tax break on jobless aid only applies to federal income tax. Typically unemployment is considered taxable income at. The exemption which applied to federal taxes meant that unemployment checks sent during the pandemic werent counted as earned income.

If your modified adjusted gross income AGI is less than 150000 the American Rescue Plan Act enacted on March 11 2021 allows you to exclude from income up to 10200 of unemployment compensation paid in 2020. The IRS has identified 16. On 2020 tax returns and issuing refunds averaging around 1600 to those who qualify for a 10200 unemployment tax.

Select your language pressing 1 for English or 2 for Spanish.

Matt Bee Unemployment Tax Guy Unemploymenttax Twitter

Unemployment Tax Refund Update What Is Irs Treas 310 11alive Com

Loan Payment Spreadsheet Personal Financial Planning Financial Planning Financial Plan Template

3 12 154 Unemployment Tax Returns Internal Revenue Service

Unemployment Tax Refund Update What Is Irs Treas 310 11alive Com

3 12 154 Unemployment Tax Returns Internal Revenue Service

3 12 154 Unemployment Tax Returns Internal Revenue Service

3 12 154 Unemployment Tax Returns Internal Revenue Service

3 12 154 Unemployment Tax Returns Internal Revenue Service

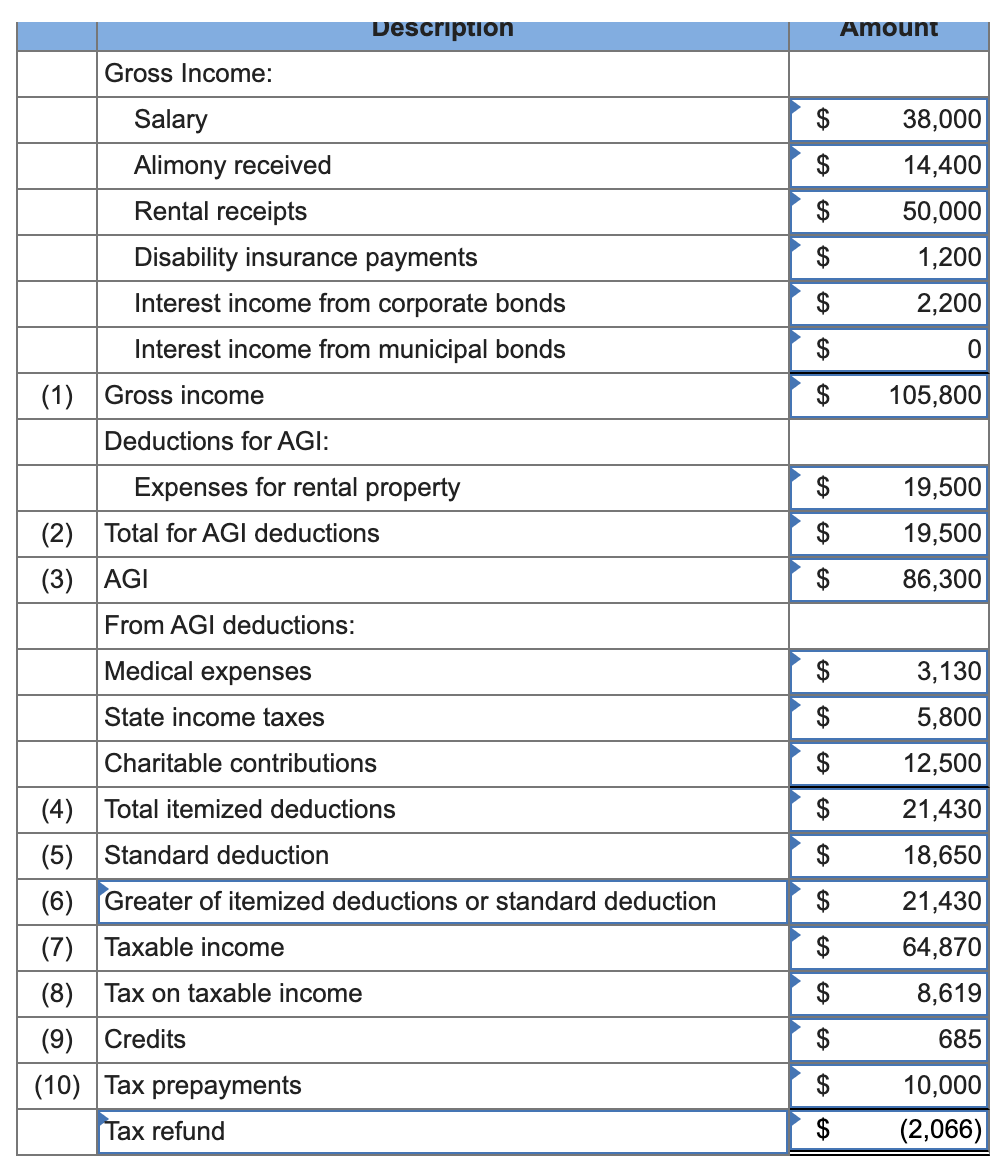

I Have Some Answers Filled In But I Don T Know If Chegg Com

Unemployment Tax Refund Update What Is Irs Treas 310 11alive Com

Us Tax Court Archives Tax Controversy 360

Matt Bee Unemployment Tax Guy Unemploymenttax Twitter

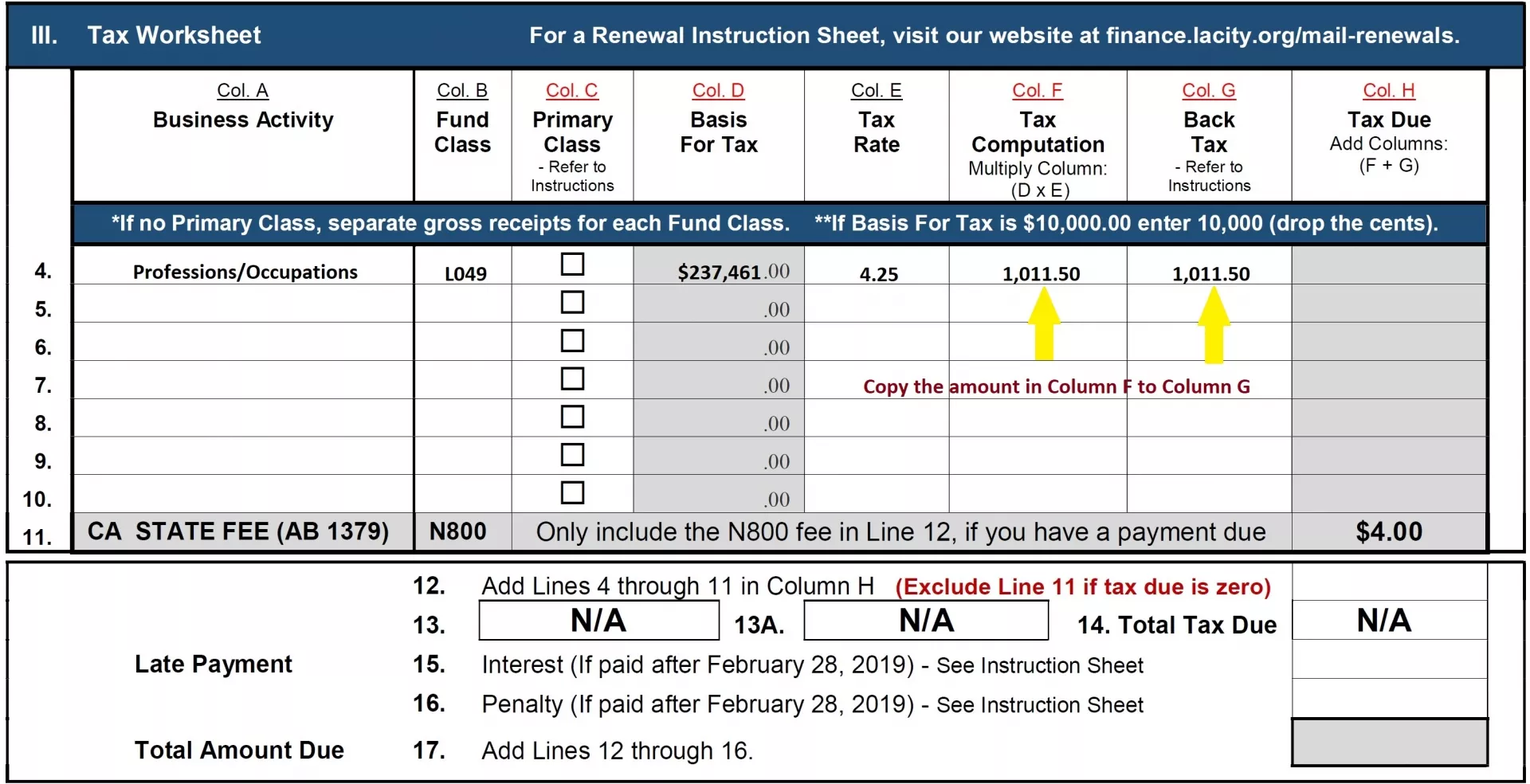

Business Tax Renewal Instructions Los Angeles Office Of Finance

Indian Shares End Flat Private Lenders Fall While Reliance Metal Stocks Gain Private Lender Financial Stocks Initial Public Offering

Matt Bee Unemployment Tax Guy Unemploymenttax Twitter

3 12 154 Unemployment Tax Returns Internal Revenue Service

Matt Bee Unemployment Tax Guy Unemploymenttax Twitter

Child Tax Credit Monthly Payments To Begin Soon The New York Times